Be Protected from the Unexpected.

Be Protected from the Unexpected.

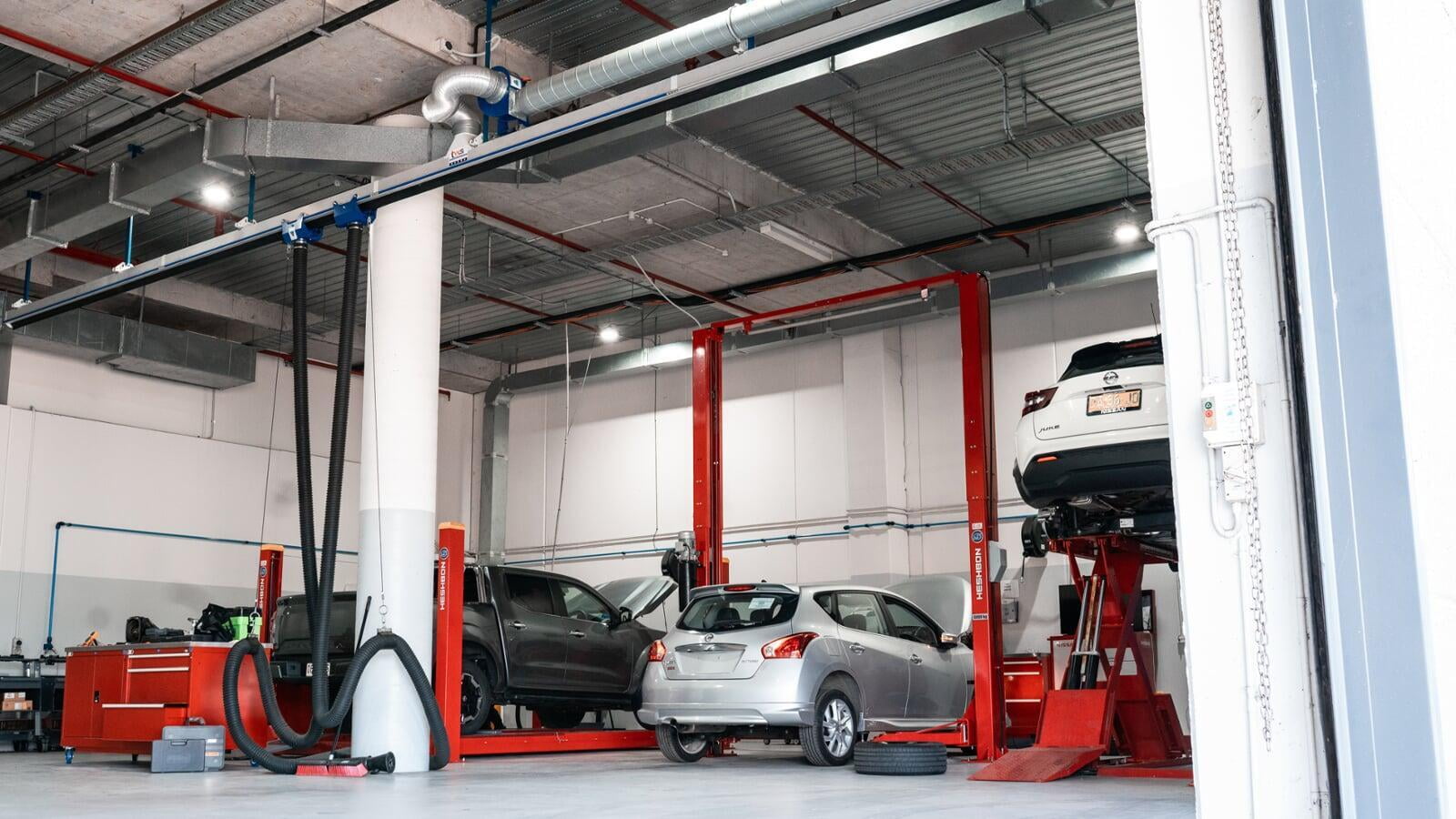

As a business owner, insurance for your assets and operational liabilities is a key consideration to be protected from the unexpected. Here is an overview of the insurance products most commonly relevant to businesses in the automotive trade.

What’s available under tailored Business Insurance with Scott & Broad

Material Loss or Damage

Covers physical loss or damage to business assets from sudden, unexpected events such as fire or storms.

Business Interruption

Protects loss of income due to material loss or damage.

Public and Product Liability

Covers legal liability for injury to third parties or damage to their property.

Customer Motor Vehicle

Covers customer vehicles on your premises for damage or theft.

Burglary

Covers loss of contents or stock due to theft involving forcible and violent entry.

Money

Covers business money on premises and in transit.

Glass

Covers replacement costs for internal or external glass following damage.

Computer & Electronic Equipment

Covers breakdown of electronic devices.

General Property

Covers portable property like laptops against loss or damage.

Machinery Breakdown

Covers sudden breakdowns of essential machinery.

Tax Audit

Covers Accountant's fees related to audits conducted by the ATO.

Professional Risks

Covers costs arising from incorrect advice.